Do you own real estate? Is it your home? A vacation home? Or rental property? It’s important to pay special attention to how you own your real estate. Here we take a look at the different types of real estate and information about the best form of ownership. This is important when you’re thinking about estate planning and asset protection. Your Home Because your primary residence (your homestead) receives special tax treatment, be very careful with how you own your home. In states like Florida, tenancy by the entirety offers married couples creditor protection. This protection is from the creditors of one of the spouses while still preserving relevant tax benefits. It also allows automatic transfer of ownership to the surviving spouse upon the death of the first spouse without court involvement. Transferring ownership of the primary residence to a joint revocable trust may also be an option if you live in a state that allows the tenancy of the entirety protection to transfer to the joint revocable trust. Ownership by the trust also means that the real estate will pass through the trust document instead of the probate process.…Read More

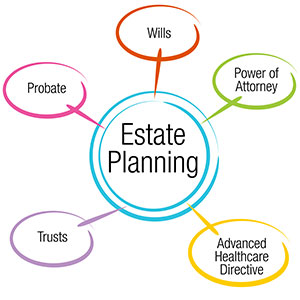

A Living Will Details The Health Care That You Want If You End Up On Life Support A living will, also called a health care directive, gives you the power to take control over what medical treatment you do or don’t want administered, in the event that you become unconscious or incapacitated. To learn more about health care directives, watch this short video. A Living Trust (also known as a revocable living trust) is created during an individual’s lifetime where a designated person, the trustee, is given responsibility for managing that individual’s assets for the benefit of the eventual beneficiary. A trust is a legal document that you create during your lifetime. Just like a will, a trust spells out your wishes with regard to your assets, your dependents, and your heirs. A trust can bypass the costly and time-consuming process of probate. This lets your successor trustee (who fills basically the same role as an executor of a will) to carry out your instructions as documented in your trust at your death. Your successor trustee also steps in if you’re unable to manage your financial, healthcare, and legal affairs…Read More

Do You Need A Will (Last Will And Testament) Or Revocable Living Trust? How Do You Choose? Are you interested in a will or revocable living trust? Wills and trusts are useful estate planning tools. They serve different purposes and can even work really well together. First, let’s go over key differences between wills and trusts. Will Characteristics: A will goes into effect only after you die. It only covers property that is in your name at your death. A will passes through a court process called Probate. The Probate court oversees the will’s administration and ensures the will is valid and that the property gets distributed the way the deceased wanted. Because a will passes through Probate, it’s a public record. A will lets you name a guardian for your minor children. There Is A Good Chance That If You Care About How Beneficiaries Use What You’re Leaving Them Or Want Someone Else To Manage It, You’re Going To Need Some Type Of Trust The two main types of trusts are testamentary trusts and revocable living trusts. One type of trust is inside your will and the other type…Read More

Do You Have A Beneficiaries In Your Last Will And Testament, Life Insurance And Retirement Accounts? Here Are Some Important Things You Need To Know Beneficiaries Of A Last Will And Testament Have To Wait First, you use a Will (Last Will and Testament) to give assets to your beneficiaries, your beneficiaries don’t inherit automatically. Those beneficiaries will need to wait until the probate court process is over before they can inherit. In some cases, this can take many months or even years. If the estate is complex, the legal fees can deplete that inheritance. If avoiding probate is a top priority, consider a Revocable Living Trust as part of your estate plan. Go here to learn more about wills and trusts. Go here to learn more about avoiding probate. Your Last Will And Testament Does Not Control Your Retirement Plan And Life Insurance Policy Benefits Second, assets in a life insurance policy or retirement plan pass to your beneficiaries directly, bypassing your Will (Last Will and Testament). Your beneficiaries will receive these assets after completing a claim form. [CTACustomJohnsonbox] Minor Children Should Not Inherit Directly. Consider A Trust Don’t…Read More

If you have a pet, he or she probably feels like part of your family. So it makes sense to take care of your pet if you become incapacitated or pass away. Because if you don’t make any plans, your beloved companion could end up in an animal shelter or worse. The law looks at pets as personal property. So you can’t just name your pet as a beneficiary of your will or trust without some careful planning. Be Careful With Your Will Since you can’t name your pet as a beneficiary, you might consider leaving your pet and money for its care in your will to a trusted person who would be your pet’s new caregiver. But your pet’s new caregiver would not be legally required use the funds properly. In fact, your pet’s new owner could legally keep all of the money for themselves and drop off your beloved friend at the local shelter. You’d like to think that you could trust someone to take care of your pet if you leave him or her money in your will to do so. But it’s impossible to predict what…Read More

When the wealthy financier, Jeffrey Epstein, died under mysterious circumstances (the Medical Examiner determined that is a suicide, but many people are skeptical), he left behind a huge fortune close to $600 million, along with creditors and lawsuits. Just two days before his death, he signed his Will, which left his estate to his trust, the 1953 Trust. Because that Trust is not filed with the Court, its contents should remain private, barring litigation involving the Trust’s beneficiaries or trustee’s duties. In the Will, Epstein is listed as a resident of the U.S. Virgin Islands. After his death, his Will was filed in the U.S. Virgin Islands, probably because his attorneys thought the probate process would be more private. For regular people who are not rich or famous, privacy is still a huge deal. That is why many people opt for using trusts in their estate planning, instead of just relying on a Will. Here are some important differences between a Will and a Trust: Will Characteristics: A will goes into effect only after you die A will only covers property that is in your name at your death A…Read More

This article is part of a series discussing the true costs and consequences of failed estate planning. The series highlights a few of the most common—and costly—planning mistakes we encounter with clients. If the series exposes any potential gaps or weak spots in your plan, meet with us to learn how to do the right thing for the people you love. If you’re like most people, you probably view estate planning as a burdensome necessity—just one more thing to check off of life’s endless “to-do” list. You may shop around and find a lawyer to create planning documents for you, or you might try creating your own DIY plan using online documents. Then, you’ll put those documents into a drawer, mentally check estate planning off your to-do list, and forget about them. The Problem Is, Your Estate Plan Is Not A One-And-done Type Of Deal In fact, if it’s not regularly updated when your assets, family situation, and/or the laws change, your plan will be totally worthless when your family needs it. Moreover, the failure to regularly update your plan can create its own unique set of problems that can…Read More

Parents want their children to be taken care of after they die. But children with disabilities have increased financial and care needs, so ensuring their long-term welfare can be tricky. Proper planning is necessary to benefit the child with a disability, including an adult child, as well as assist any siblings who may be left with the care taking responsibility. Special Needs Trusts The best and most comprehensive option to protect a loved one is to set up a special needs trust (also called a supplemental needs trust). These trusts allow beneficiaries to receive inheritances, gifts, lawsuit settlements, or other funds and yet not lose their eligibility for certain government programs, such as Medicaid and Supplemental Security Income (SSI). The trusts are drafted so that the funds will not be considered to belong to the beneficiaries in determining their eligibility for public benefits. There are three main types of special needs trusts: #1 A First-Party Trust A first-party trust is designed to hold a beneficiary’s own assets. While the beneficiary is living, the funds in the trust are used for the beneficiary’s benefit, and when the beneficiary dies, any assets…Read More

Since estate planning involves thinking about death, many people put it off until their senior years, or simply ignore it all together until it becomes too late. This kind of unwillingness to face reality can create a major hardship, expense, and mess for the loved ones and assets you leave behind. While not having any estate plan is the biggest blunder you can make, even those who do create a plan can run into trouble if they don’t understand exactly how estate plans work. Here are some of the most common mistakes people make with estate planning: 1. Not Creating A Will While wills aren’t the ultimate estate planning tool, they are one of the bare minimum requirements. A will lets you designate who will receive your property upon your death, and it also allows you to name specific guardians for your minor children. Without a will, your property will be distributed based on your state’s intestate laws (which probably don’t align with your wishes), and a judge who doesn’t know you or your family, will choose a guardian for your children under 18. On top of that….your kids will…Read More