When it comes to COVID-19, there is so much that feels beyond our control. With estate planning (wills or trusts and more), there are things that you CAN control. Here is a list of things you can do (from an estate planning perspective) that may help you feel a little more in control: #1 During this COVID-19 crisis, who are your emergency health care decision makers? Talk to your loved ones about your wishes regarding your medical care. First, who would you want to step up to advocate for you during a health care crisis? The two parts of Health Care Directives are the Designation of Health Care Surrogate and Living Will. With the Designation of Health Care Surrogate, you nominate someone you trust to make health care decisions for you in the…Read More

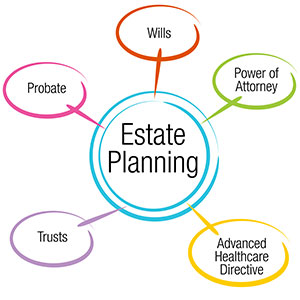

Do You Need A Will (Last Will And Testament) Or Revocable Living Trust? How Do You Choose? Are you interested in a will or revocable living trust? Wills and trusts are useful estate planning tools. They serve different purposes and can even work really well together. First, let’s go over key differences between wills and trusts. Will Characteristics: A will goes into effect only after you die. It only covers property that is in your name at your death. A will passes through a court process called Probate. The Probate court oversees the will’s administration and ensures the will is valid and that the property gets distributed the way the deceased wanted. Because a will passes through Probate, it’s a public record. A will lets you name a guardian for your minor children.…Read More

How can we help seniors manage their finances? With these tips, seniors can manage their finances better. And if they ever need help, they can shift their financial management to someone they can trust. 1. Use direct deposit. First, use direct deposit for income form pensions, annuities, and Social Security benefits. Not only will this save a trip to the bank, it also avoids the risk of a paper check being stolen, lost, or forgotten. 2. Consolidate retirement accounts. Consolidating retirement accounts into fewer accounts may make it easier to evaluate and manage savings, as well as to take any minimum distributions that are required. Also, when moving money between retirement accounts, it’s a good idea to use a trustee-to-trustee transfer rather than moving the money yourself. 3. Consolidate financial accounts. It can…Read More

Are you a senior worried about identity theft? Or are you worried about a loved one with dementia becoming a victim of identity theft? Here are some tips on freezing someone’s credit. This is important if you’re trying to protect someone from elder abuse. What Does It Mean To Freeze Credit? A credit freeze restricts access to your credit report, making it harder for identity thieves to open new accounts in your name. To Place Or Lift A Credit Freeze, You Must Contact Each Credit Bureau Separately. Equifax: equifax.com or 800-695-1111 Experian: experian.com or 888-397-3742 TransUnion: transunion.com or 888-909-8872 Once a credit freeze is in place, it secures your credit file until you lift the freeze. You can do that online, by phone, or by mail using the special PIN the companies give…Read More

In Part 1 of this series, we discussed how some professional adult guardians have used their powers to abuse the seniors placed under their care. Here, we’ll discuss how seniors can use estate planning to avoid the potential abuse and other negative consequences of court-ordered guardianship. As our senior population continues to expand, an increasing number of elder abuse cases involving professional guardians have made headlines. The New Yorker exposed one of the most shocking accounts of elder abuse by professional guardians, which took place in Nevada and saw more than 150 seniors swindled out of their life savings by a corrupt Las Vegas guardianship agency. The Las Vegas case and others like it have shed light on a disturbing new phenomenon—individuals who seek guardianship to take control of the lives of vulnerable…Read More

Medicaid is the government’s long-term care insurance for seniors and the disabled. There are income and asset eligibility requirements that must be met in order to qualify. One big issue is the transfer of assets. In order to be eligible for Medicaid, you cannot have recently transferred assets. Congress does not want you to move into a nursing home on Monday, give all your money to your children (or whomever) on Tuesday, and qualify for Medicaid on Wednesday. So it has imposed a penalty on people who transfer assets without receiving fair value in return. This penalty is a period of time during which the person transferring the assets will be ineligible for Medicaid. The penalty period is determined by dividing the amount transferred by what Medicaid determines to be the average…Read More

Whether it’s called “The Great Wealth Transfer,” “The Silver Tsunami,” or some other catchy-sounding name, it’s a fact that a tremendous amount of wealth will pass from aging Baby Boomers to younger generations in the next few decades. In fact, it’s said to be the largest transfer of inter-generational wealth in history. Because no one knows exactly how long Boomers will live or how much money they’ll spend before they pass on, it’s impossible to accurately predict just how much wealth will be transferred. But studies suggest it’s somewhere between $30 and $50 trillion. Yes, that’s “trillion” with a “T.” A Blessing Or A Curse? And while most are talking about the benefits this asset transfer might have for younger generations and the economy, few are talking about its potential negative ramifications. Yet…Read More

The number of older Americans with student loan debt – either theirs or someone else’s — is growing. Sadly, learning how to deal with this debt is now a fact of life for many seniors heading into retirement. According to by the Consumer Financial Protection Bureau, the number of older borrowers increased by at least 20 percent between 2012 and 2017. Some of these borrowers were borrowing for themselves, but the majority was borrowing for others. The study found that 73 percent of student loan borrowers age 60 and older borrowed for a child’s or grandchild’s education. Before You Co-sign A Student Loan For A Child Or Grandchild, You Need To Understand Your Obligations The co-signer not only vouches for the loan recipient’s ability to pay back the loan, but is also personally…Read More

Paying for day care is one of the biggest expenses faced by working adults with young children, a dependent parent, or a child with a disability. But there is a tax credit available to help working caregivers defray the costs of day care (for seniors it’s called “adult day care”). In Order To Qualify For The Tax Credit, You Must Have A Dependent Who Cannot Be Left Alone And Who Has Lived With You For More Than Half The Year Qualifying dependents may be the following: A child who is under age 13 when the care is provided A spouse who is physically or mentally incapable of self-care An individual who is physically or mentally incapable of self-care and either is your dependent or could have been your dependent except that his or…Read More

A California daughter and granddaughter’s fear of losing their home to Medicaid may have contributed to a severe case of elder abuse. If They Had Consulted With An Elder Law Attorney, They Might Have Figured Out A Way To Get Their Mother The Care She Needed And Also Protect Their House Amanda Havens was sentenced to 17 years in prison for elder abuse after her grandmother, Dorothy Havens, was found neglected, with bedsores and open wounds, in the home they shared. The grandmother died the day after being discovered by authorities. Amanda’s mother, Kathryn Havens, who also lived with Dorothy, is awaiting trial for second-degree murder. According to an article in the Record Searchlight, a local publication, Amanda and Kathryn knew Dorothy needed full-time care, but they did not apply for Medicaid on her…Read More